HOW DONORS HELP

Every donation to Intermountain Centers supports the agency’s mission of providing the highest quality, community-based, individualized services to at-risk Arizonans. Contributions of cash and/or goods and services from individuals, foundations and corporations supply Intermountain Centers for Human Development with critically needed funds which enhance our clients’ lives- nearly 20,000 children, adults, and their families each year.

Gifts may be designated to programs in any location, to specific programs for children or adults, or to a specific facility within a program. Undesignated gifts are used to offset expenses in the area of greatest need and secure a future built on our clients’ individual strengths and interests.

Intermountain staff members are firmly committed to addressing the needs of those we serve in individualized ways that integrate strength, culture, and greater independence. We need your help in creating positive new life skills and building lives for at-risk members of the Arizona communities we serve and in developing new opportunities for Arizona families that lack the resources to provide for their children!

DONATIONS TO INTERMOUNTAIN QUALIFY FOR THREE DIFFERENT ARIZONA TAX CREDITS:

- Arizona Charitable Tax Credit (formerly Working Poor Tax Credit)

- Donations can be made by using the donate form on this page, by mail, or by calling (520) 721-1887 ext. 1149. You can donate up to $987 when filing jointly or up to $495 when filing as an individual

- QCO# 22041

-

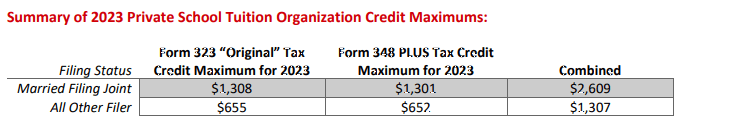

- Private School Tax Credit

- Donations designated for the Intermountain Academy can be made to support the educational programs for children diagnosed with autism through the Institute for Better Education (IBE) website: IBEscholarships.org. You can donate up to $2,435 for a married couple or $1,219 as an individual. Be sure to designate your donation to Intermountain Academy.

- Any donation up to the maximum amount qualifies for each Arizona tax credit. Make one or both donations… and it won’t cost you anything.

- PLUS “Switcher” Tax Credit Program

- The Private Learning Uplifting Students (PLUS) tax credit allows donors to receive credit for a contribution over and above the original tax credit. The Arizona tax payer must first donate the maximum for the Original School Tuition Organization Tax Credit in order to donate an additional amount for the PLUS “Switcher” tax credit. The PLUS “Switcher” credit amount for 2023 is $1,301 for “married filing jointly” and $652 for all other taxpayers.

- Donations made between January 1, 2024 and April 15, 2024 can be claimed on either your 2023 or 2024 state tax return.

DONATING IS EASY AND TAX DEDUCTIBLE

Thank you for your interest in our work. Intermountain Centers is a 501(c)(3) non-profit corporation. Donations are deductible to the extent allowed by federal law. The State of Arizona allows you to receive a dollar-for-dollar Tax Credit on your state income tax when you donate to Intermountain Centers.

We welcome your cash gifts, made by telephone at 520-721-1887 (ext. 1149), check mailed to Intermountain Centers for Human Development, 401 N. Bonita Ave, Tucson AZ 85745, or online donation through our website.

For information on making or designating such a gift, establishing a bequest or endowment, designating Intermountain as a beneficiary of life insurance, or gifting personal property, or making a donation to the Intermountain Academy, please contact:

Royce Sparks

Director, Communications and Philanthropy

401 N. Bonita Ave

Tucson, AZ 85745

(520) 721-1887

rsparks@ichd.net