Reprint: Safford’s Intermountain Centers getting a T-Mobile Hometown Grant

Reprint: Intermountain Receives HS Lopez Family Foundation Grant

Eric Rankin Joins Intermountain Centers for Human Development

Reprint: Intermountain Centers VP receives Fundraiser of the Year nomination

Reprint: Intermountain Centers VP Nominated for National Fundraiser of the Year Award

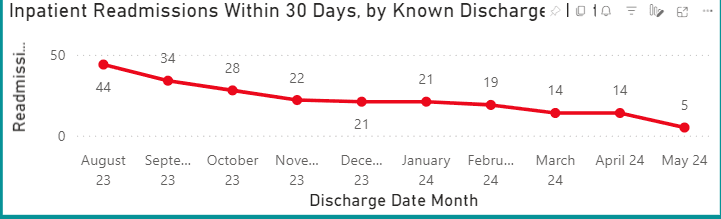

Changing the Landscape of Arizona’s Healthcare System

New Initiative Saves Emergency Services Funds, Reduces Wait Times for Critical Medical Care

Miguel Cruz Joins Intermountain Centers' Board of Directors

2024: Giveaways with a Purpose

Throughout 2024 we will be partnering up with a series of like-minded organizations who have generously donated items, subscriptions, and services to help raise awareness for the many impactful programs and services we offer.

Successful Outcomes

Earlier this year, a member in Yuma was released from jail and found themselves living in their vehicle, while her children sought refuge with a relative. With the weight of their situation bearing down, she reached out to Community Partners Integrated Healthcare (CPIH) for assistance.

New Family Housing Program

New Program is Empowering Families through Housing and Support Services

Congratulations

Affiliates of Intermountain Centers have been recognized as Centers of Excellence by Banner University Health Plans, Arizona Complete Health, and United Healthcare. Centers of Excellence (COEs) are specialized care programs that meet high-quality standards and have exceptional outcomes.

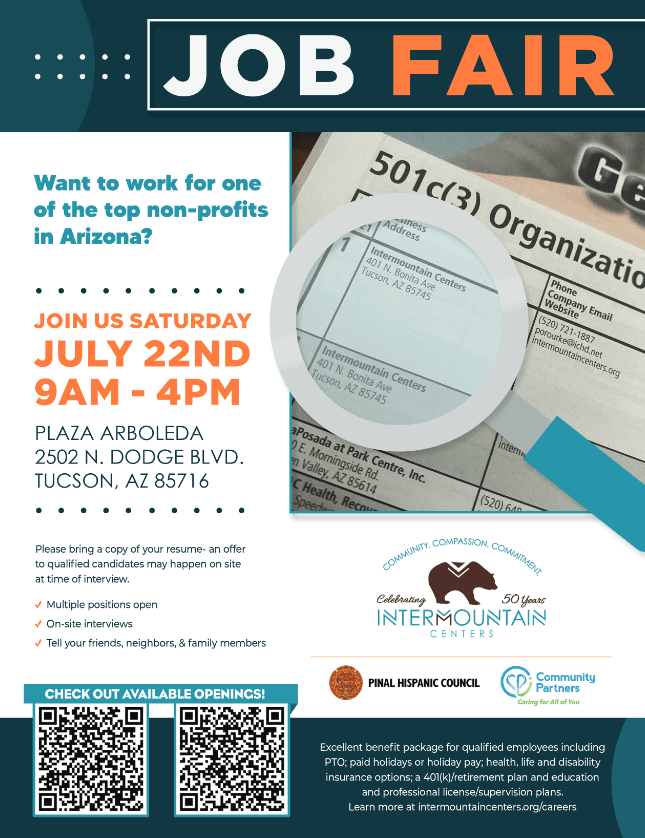

INTERMOUNTAIN JOB FAIR

Want to work for one of the top non-profits in Arizona?

Join us

Saturday, July 22nd

9am-4pm

50TH ANNIVERSARY GALA

Join us as we celebrate 50 years of Community, Compassion, and Commitment.

Friday, April 28, 2023 @ Tucson Convention Center

New Park is Approved by Mayor and Council

City of Tucson and Intermountain Centers partner to develop a park specific to those on the autism spectrum.

Intermountain in the News – KGUN 9 on your Side Tucson – Autism-friendly park for kids to begin development in Downtown Tucson

Intermountain in the News – KGUN 9 on your Side Tucson – Autism-friendly park for kids to begin development in Downtown Tucson

A Message to Our Supporters

Paramount to Intermountain Centers is the health and well-being of its staff and those we serve. As a frontline provider of health and human services we have been forced to pivot with regard to how we provide primary care, behavioral health care, substance use treatment, and specialized educational services.

Intermountain in the News – KVOA Tucson – Autism-friendly park proposed for downtown Tucson

The City of Tucson is proposing an autism-friendly park for the downtown area.

Tucson Opinion: No doubt that 2020 has been a psychologically toxic year

Over the years, we have told a single story of mental health that usually ends with, “he/she has problems.” The diagnosis of a mental health condition has often been communicated in a negative context, thus it has led to the belief that people suffering from a mental health disorder are not “normal.”

Success Story - Jessica

The member will graduate high school in May, 2021, with the goal of working and eventually becoming a veterinary technician.

Success Story - Brian

We were so proud of him, and Brian of himself – we all teared up at his graduation. Brian is now in Intermountain Academy’s LIFT Program, focusing on job skills.

Success Story - Rob

Over the years, I have reached out and found fabulous organizations to assist Rob with much-needed services. I am currently working with Intermountain Centers, here in Tucson, and Rob is flourishing.